USDC Ecopedia

USDC is a stablecoin that blends the reliability of the US dollar with the efficiencies of blockchain technology. Fully backed by cash and cash-equivalent liquid assets, USDC enables fast, low-cost transactions 24/7 and operates across many major blockchain networks.

As a digital dollar, USDC provides users around the world with a secure and stable medium of exchange. It is designed for seamless global payments, savings, trading and commerce — serving as a foundational layer for digital finance.

.png?auto=webp&quality=10)

Who built USDC and how did it start?

USDC was launched in 2018 by Circle, a global fintech company. Designed to mirror the stability of the US dollar while leveraging blockchain’s power, USDC is fully reserved and redeemable 1:1 for USD.

✔️ 2018: Launched by Circle to bring the dollar to the internet

✔️ USDC is backed 100% by US dollars in the form of highly liquid cash and cash-equivalent assets

✔️ Operates across 20 blockchains including Ethereum, Solana, Sui and more

✔️ Monthly attestation reports confirm reserves, reinforcing transparency and trust

How does USDC work?

When you hold USDC, you’re holding a digital version of the US dollar. Behind every 1 USDC is a real dollar (or short-term US Treasury equivalent) sitting safely in reserve. These funds are held with regulated financial institutions and aren’t touched by Circle for any other purpose.

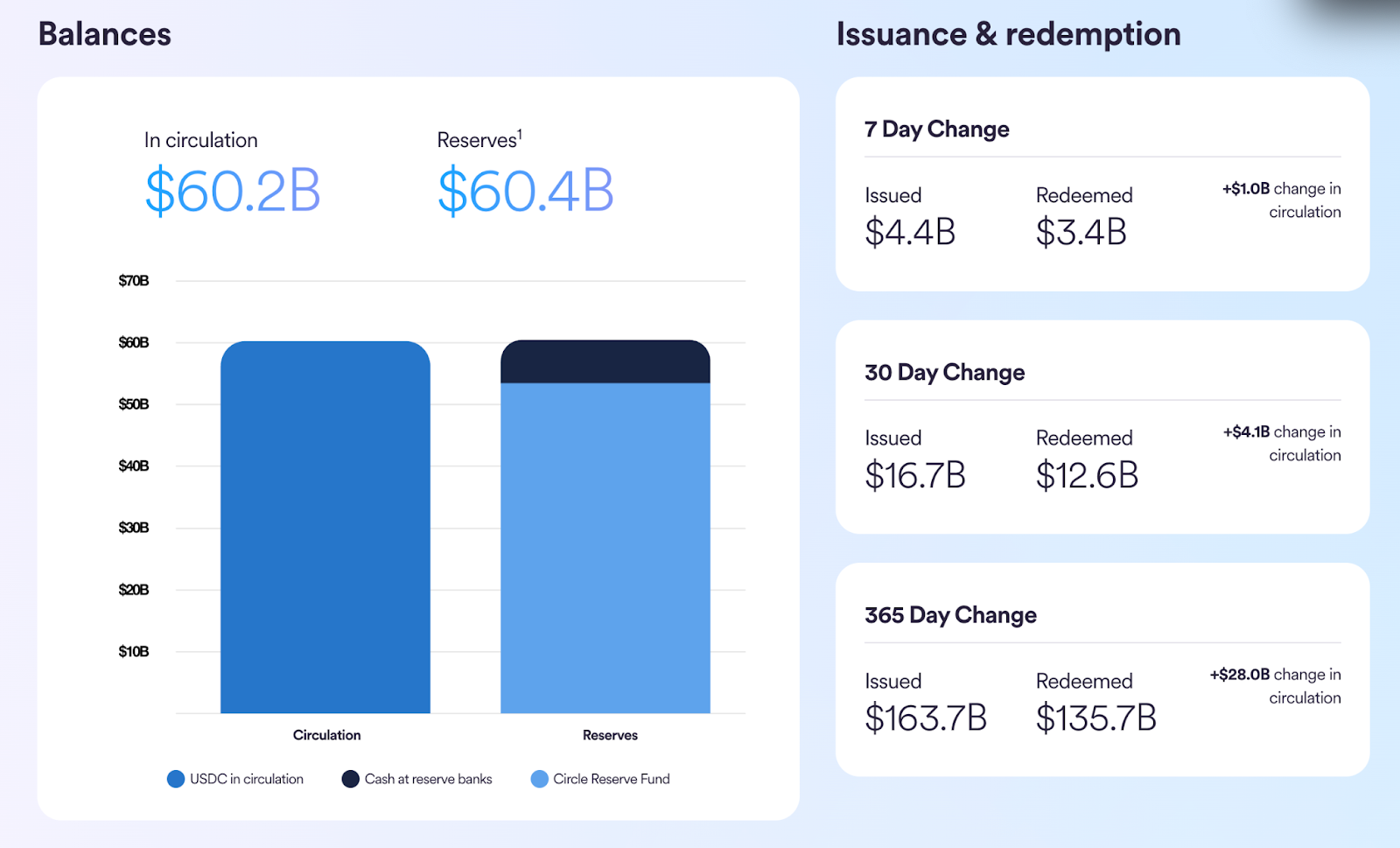

USDC reserve holdings are fully disclosed on a weekly basis, along with associated mint/burn flows. Additionally, a Big Four accounting firm provides monthly third-party assurance that the value of USDC reserves are greater than the amount of USDC in circulation. These reports are shared publicly on the Circle Transparency & Stability website. That means anyone can verify that every USDC in circulation is fully backed and accounted for at all times.

Multichain dominanceUSDC isn’t locked to one network. It’s available across 20 blockchains, including Ethereum, Solana, Polygon, Base and more. This makes it one of the most flexible and widely supported stablecoins out there.

Championing onboardingUSDC makes it simple to step into crypto. It’s stable, easy to understand and available on almost all major platforms, such as Bybit. You can buy it directly with your local currency, receive it from someone else or convert other crypto into it.

From everyday payments to pro trading use cases

USDC isn’t just a stablecoin; it’s designed for real utility across different parts of the crypto economy. From payments and remittances to yield opportunities and institutional-grade trading, USDC is built to support a wide range of use cases.

Learn more about how you can get started by exploring below.

.png?auto=webp&quality=10)

.png?auto=webp&quality=10)

.png?auto=webp&quality=10)

.png?auto=webp&quality=10)

.png?auto=webp&quality=10)

.png?auto=webp&quality=10)

.png?auto=webp&quality=10)

.png?auto=webp&quality=10)

.png?auto=webp&quality=10)

.png?auto=webp&quality=10)